how are 457 withdrawals taxed

Roth 401ks though have RMDs albeit tax-free You can. Withdrawals are subject to income tax.

Moving Out Of State Don T Forget About The Source Tax Mullin Barens Sanford Financial

So if you have the option of a 401 k and a 457 and youre under the age of 50 you can contribute up to 38000 a year between the two plans.

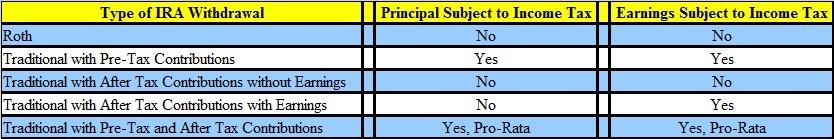

. For this calculation we assume that all contributions to the retirement account. Rollovers to other eligible retirement plans 401 k 403 b governmental 457 b IRAs No. A 457b is a type of tax-advantaged retirement plan for state and local government employees as well as employees of certain non-profit organizations.

Use this calculator to see what your net withdrawal would be after taxes are. Employees are taxed on distributions from a 457 retirement plan if the distributions are includible in the participants income. Availability of statutory period to correct plan for failure.

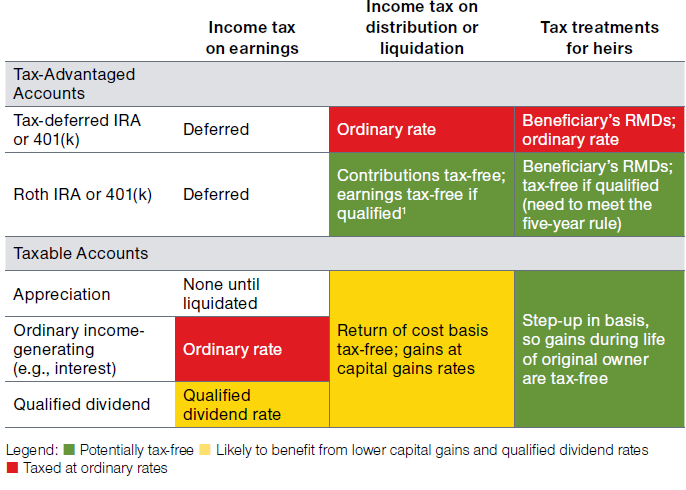

Posted November 11 2014. All distributions from IRAs 401 ks 403 bs and 457 accounts are subject to income taxes at ordinary income tax rates. You are permitted to withdraw money from your 457 plan without any penalties from the Internal Revenue Service no matter how old you are.

My question was related to 457 withdrawals which generate a 1099-R for tax season. The tax treatment of distributions from 457 government plans and 401k plans differs in some significant ways. However if you withdraw.

The differences are partly due to the historical origin of 457. 5 457b Distribution Request form 1 Page 3 Federal tax law requires that most distributions from governmental 457b plans that are not directly rolled over to an IRA or other eligible. If you have a 457 plan and you die your beneficiary can take distributions from the plan immediately.

Unlike with 401 ks and 403 bs the IRS wont slap you with a penalty on withdrawals you make before age 59. Ad See How a 457b Could Help You Meet Your Goals And Save For Tomorrow. Your investment gains are also tax-free as long as youre at least 59½ and have owned the account for five years.

Theres a good reason for that Durand says. However you will have to pay. You will however owe income tax on all withdrawals regardless of.

Early distributions those before age 59 12 from 457 b plans are not subject to the 10 percent penalty that 401 k plans are. Plans of deferred compensation described in IRC section 457 are available for certain state and local governments and non-governmental entities tax exempt under IRC Section 501. A distribution is not included in income and therefore.

Ad See How a 457b Could Help You Meet Your Goals And Save For Tomorrow. Withdrawing money from a qualified retirement account such as a 457 plan can create a sizable tax obligation. Beneficiary distributions avoid the early withdrawal penalty of 10.

The 457 is similar to the more widely known 401k plan where you can choose to contribute to the 457 plan through automatic deductions from your paycheck before the taxes. In my experience if a non-profit employer discusses the implications of 457 f in advance with a competent professional it will know how 457 f. Deferred Comp contributions do not show up on a W2 as earnings.

Here is a list of the key rules. The amount you wish to withdraw from your qualified retirement plan. Employers report any distribution from a 457 plan on Form W-2 the annual Wage and Tax Statement that arrives each January for payments made in the.

Sec 457 F Plans Get Helpful Guidance Journal Of Accountancy

5 Tax Savvy Retirement Withdrawal Strategies Apprise Wealth Management

A Guide To 457 B Retirement Plans Smartasset

How To Make Your Retirement Account Withdrawals Work Best For You T Rowe Price

What Are Defined Contribution Retirement Plans Tax Policy Center

Pre Tax Vs Roth 401 K Contributions Youtube

Hey Gig Worker Prepare For A Lot More Work When You File Your Taxes In 2022 Filing Taxes Tax Time Stock News

Iras Avoid Double Taxation On Withdrawals 08 01 16 Skloff Financial Group

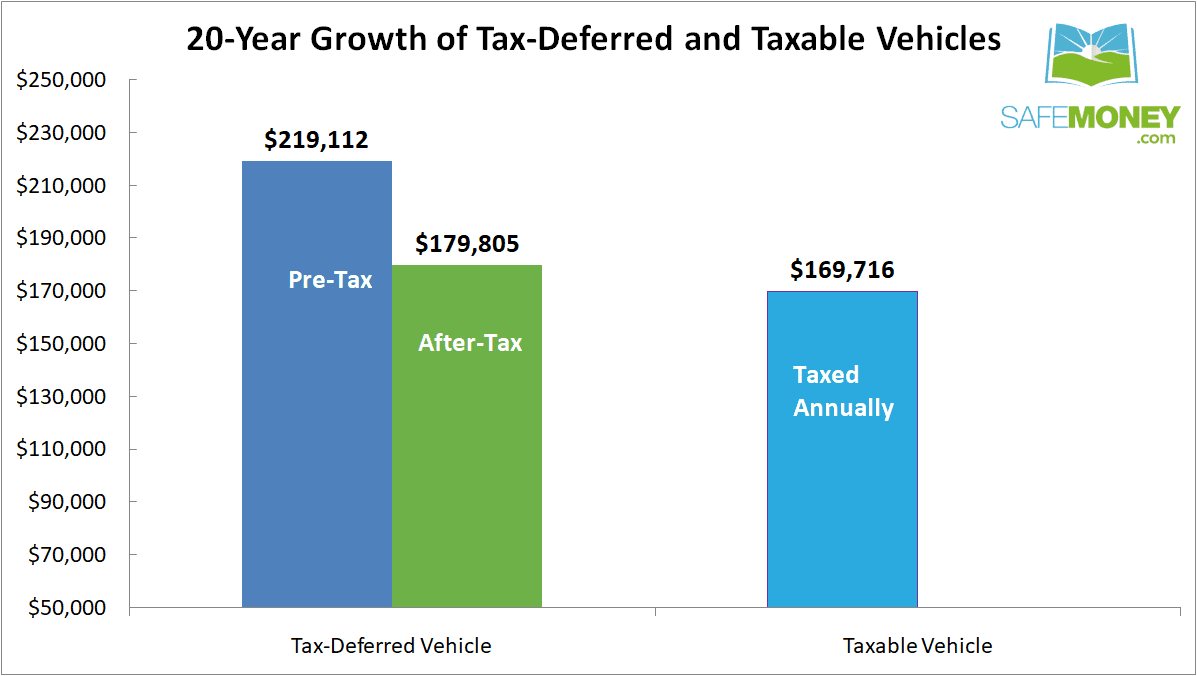

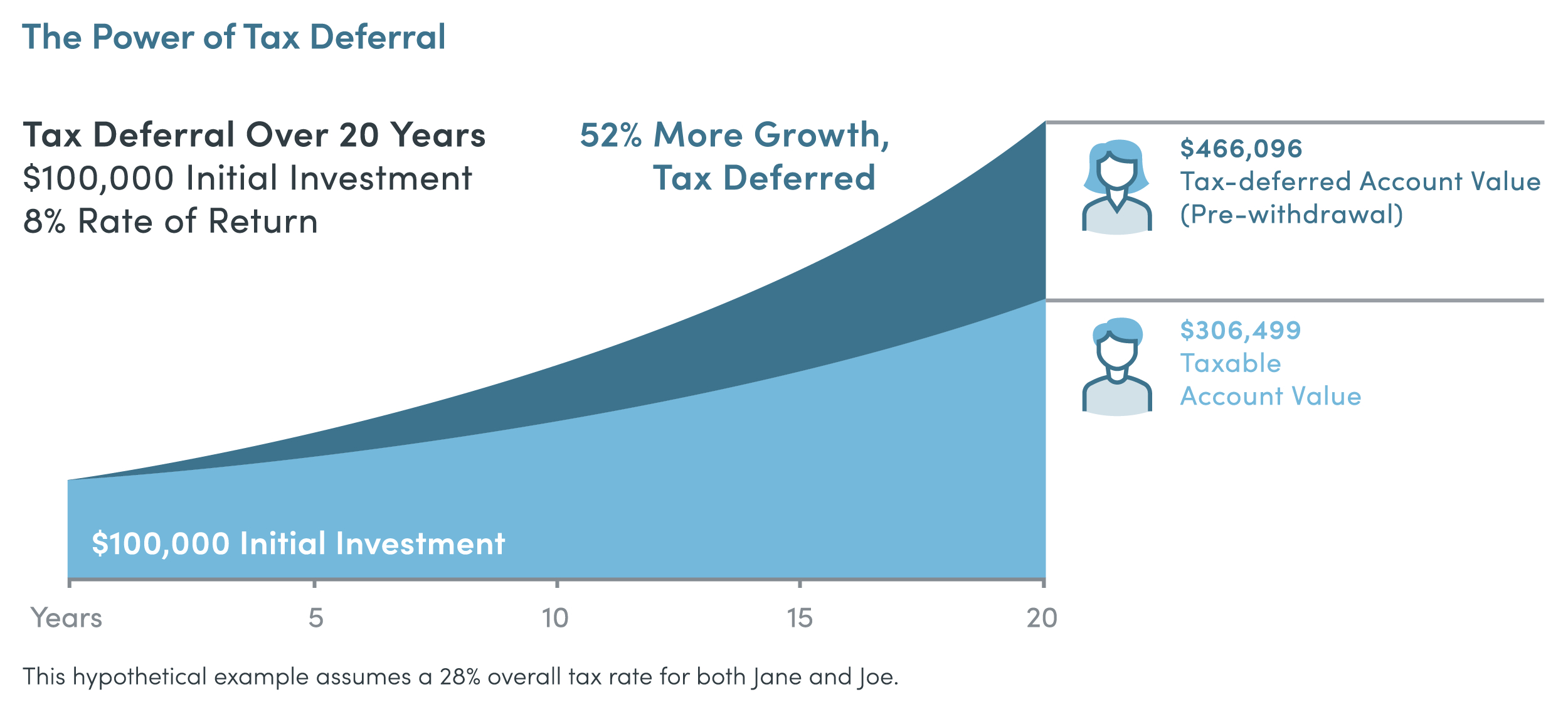

How Can Taxes Affect The Growth Of Your Money Safemoney Com

Capital Gains Tax What Is It When Do You Pay It

Retirement Income Calculator Faq

Tax Consequences Tsp Withdrawals Rollovers From A Tsp Account Part 1

The Most Tax Efficient Sequence Of Withdrawal Strategy Explained Tan Wealth Management Certified Financial Planner Cfp San Francisco Advisor

Covid 19 Early Retirement Plan Withdrawal Taxes

Pin By Kimberlee Erickson Daugherty On Financial Freedom Retirement Money Investing For Retirement Traditional Ira

Vanguard Consider The Advantages Of Roth After Tax Contributions

Make Saving For Your Future Less Taxing Security Benefit

Income Tax And Capital Gains Rates 2020 03 01 20 Skloff Financial Group